Dorae Inc. has closed its first round of external capital raising, achieving a USD 24 million valuation in a process that was several times over-subscribed.

Dorae is the leading distributed ledger technology company for raw materials.

Ricardo Santos Silva, Co-Founder and Executive Chairman of Dorae commented, "We have been very impressed with the focus and enthusiasm of investors in this round, showing the appetite that exists for quality technology projects with global reach. The track record we have in bringing successful projects to fruition has been important, as has our depth in the commodities and financial sectors. Blockchain is changing the way we do business in the same way email changed the way we communicate."

Dorae is active around the world, serving commodities supply chain participants from primary producers to end manufacturers. Independent from its users, Dorae enables compliance for processors and consumers of provenance-sensitive materials and enables automation and working capital efficiency across all products.

Aba Schubert, Co-Founder and CEO of Dorae added, "We are very excited about this support from private capital. Our first place result in the Volkswagen, Zalando and Adidas hackathon underscored our technical position in the supply chain space. And our investors recognise the commercial value in the way we act - solving a problem that exists, rather than building a solution and then looking for a problem."

Dorae has offices in Palo Alto, London and the Cayman Islands.

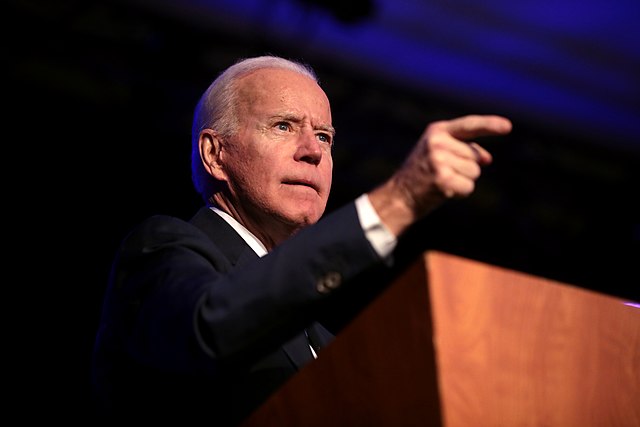

Interview with Ricardo Santos Silva at Aethel Partners LLP

Please tell me about your involvement in the deal?

We worked with Dorae to develop a deal structure that would suit their business plan and reward their new investors with an attractive position in the capital structure. Then we identified potential investors who would understand and appreciate the value proposition in Dorae’s business model, either through their own knowledge and exposure in emerging markets and commodities, through their experience in technology investment and operations, or both. Finally, we managed the deal execution to ensure a swift and smooth process for everyone.

Why is this a good deal for all involved?

Dorae got timely capital both to continue the technical build-out of their innovative distributed ledger system for raw materials and physical commodities, and to fuel their growth across markets and materials. The investors got an attractive entry valuation into a fast-growing tech business run by seasoned entrepreneurs. It was a great win-win.

What challenges arose? How did you navigate them?

Frankly, it was a fairly smooth process. We had to do a bit of groundwork in terms of explaining the nature of Dorae’s business and the tech behind it, since the area is so cutting edge. But the investors who did the deal got those concepts quite quickly and were very commercially focused, showing themselves to be great long-term partners for the business.