Understand Your Rights. Solve Your Legal Problems

Loans are great helpers when it comes to quick access to money, easy and paperless application, and reliable online lenders. Online application is what draws the attention of potential borrowers.

Who needs conventional banks with their queues and high fees when you can fill out a form online and receive loan money the same day?

However, occasions when lenders or borrowers cancel online applications sometimes do happen. What are the reasons for that and what implications this may bring? Find out here.

According to TransUnion, the number of applications for unsecured personal loan applications has risen from 15.7 million to 20.9 million from 2017 to 2020. This means that the demand for personal loan options is steadily rising.

Despite the wide availability of personal loans, borrowers may sometimes have second thoughts about their loan applications. Various repercussions may follow this decision and borrowers should be able to anticipate difficulties.

Regardless of the loan type, it’s always better to weigh all the pros and cons before applying for loans. That’s why there’s a handy pre-qualification tool available on lending websites. Pre-qualification for a personal loan affects credit score in no way. That’s a safe procedure that borrowers can go through to be sure of their ability to repay the loan.

Reasons for loan application cancellation may be different:

Whatever the reason may be, it’s essential to cancel your application before you receive money from your banking account. In most cases, it sends a single message to a support chat on the lending website. In the case of mortgage loans, for example, it takes a letter to write to the lender before signing the documents.

If you want to cancel your loan application, you need to look into the loan agreement you have on hand. The borrower doesn’t have to specify the reason for loan cancellation. However, when you do request to cancel your loan, you have to be clear and make sure your request sends the right message.

The loan agreement contains information about the cancellation clause and there are contacts to address in this case. Always follow the steps from the loan agreement to cancel the loan application. Unless you understand the loan agreement guidelines, contact a legal advisor.

If you haven’t submitted the loan application yet, you can cancel it from your online account on the lending website. Sometimes you can see the current status of your loan application. Depending on it, you will be able to cancel the application yourself or through a support chat.

Regardless of the way you contact the support group or the lender personally, you have to keep some information in mind. The lending website will need to know your full name, birth date, and application number.

When the decision in favour of the borrower has already been made, other consequences may take place. Some borrowers may allow “a window” to send your cancellation request. Lenders may allow a period from 5 to 14 days after the loan has been approved to do so.

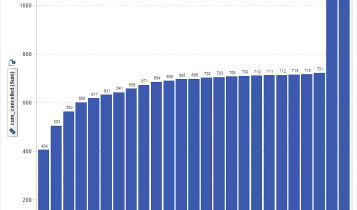

Graph by ResearchGate

If the loan money has already been transferred onto your banking account, the loan goes mostly in its traditional way. The borrower has to return the loan money within 30 days counting from the date of the cancellation notice. Some lenders are ready to forsake the origination fee and the interest on the loan. Note that you have to clarify these aspects with the lender.

If the loan amount isn’t repaid within the claimed 30 days after the cancellation notice, the loan is counted as accepted by the borrower and traditional loan features as the interest rate and any additional fees, if there are such, come into effect.

In case if the borrower cancels the application because he has a better offer, he can inform the lender of that fact. Sometimes a lender may match the offer and the borrower may get a lower interest rate or better lending opportunities with the current lender.

If you want to keep in touch with the lender and reapply for a loan in the future, you can inform the lender not to delete your details and use them next time.

Once you apply for a loan, the lender may inquire into your credit history to base his decision on. Depending on the lender, this will be either a hard check or a soft check. If the lender performs a hard check and requests your details from the credit bureau, this will make the credit score go down a bit. This is just temporary.

If you cancel the loan application before it has been issued, your credit score will stay the same. If the loan has already been issued, no matter if you cancel it, the credit score has already been affected as well.

If you cancel the loan after you have already used it up a bit, it may affect the credit score negatively. To avoid negative implications, you have to pay the remaining loan balance plus the interest rate. Foreclosure charges, fees for processing, and taxes of various kinds may fall upon you. Make sure to satisfy all of your financial responsibilities before cancelling the loan.

To sum up, cancelling a loan isn’t a bad thing. Reasons for that may be numerous and typically, there are no harsh consequences for doing so.

However, there are points to consider before canceling the loan and there’s a clear algorithm in the loan agreement to follow. Make sure you know your legal rights and responsibilities not to deal with fines for the money you have refused to take.