This month we hear from Cormac Leech and Diana Pupkevic of AxiaFunder, who outline the latest developments in litigation funding and how they stand to benefit lawyers and the wider rule of law.

“Funding is the life-blood of the justice system” - Lord Neuberger, President of The Supreme Court

Rising litigation costs have made access to justice expensive and prohibitively so for many individuals and small businesses. Many claimants are often forced to abandon or prematurely settle what are often, in our view, clearly meritorious claims. The relatively nascent but growing litigation funding sector helps to mitigate this lack of access to justice. We believe more corporate lawyers need to take the same approaches that have enabled the global stock and bond capital markets to thrive, and apply them to their own backyard — litigation.

That commercial litigation suffers from a lack of capital is evidenced by strong double-digit portfolio returns achieved by the listed litigation funders, net of losses and fees. More competition over time will increase the supply of capital and drive investor returns down to the benefit of claimants and, of course, lawyers.

Benefits of litigation funding

There are many benefits associated with the use of litigation finance. Litigation is often stressful for individuals and small companies both financially and emotionally. As soon as a claimant chooses to pursue litigation, they are inevitably taking on financial risk. This relates to both the irrecoverable costs of the litigation (i.e. ongoing legal fees) and the risk of having to pay the defendant’s costs if the claim fails (i.e. the adverse cost risk).

Litigation funding can shift these risks to a third-party funder that has a diversified portfolio of cases and underwriting expertise and, as a result, is in a far better position to carry on these risks in the first place. Non-recourse litigation funding allows claimants to pursue valuable claims without risking their own balance sheets.

A funder performs a thorough due diligence for each case by assessing many different factors (e.g. legal merits, case economics and enforceability, among others). Thus, by agreeing to provide funding, a litigation funder directly signals to the defendant that an independent party also considers the merits of the claim to be strong. Once there is a credible threat, the defendant is typically much more willing to engage in settlement discussions. According to data from Solomonic, around 80-90% of such cases settle pre-trial. Even if a litigation funder chooses not to fund a case, the claimant and their legal team may well gain some useful feedback regarding the weaknesses of the claim.

More competition over time will increase the supply of capital and drive investor returns down to the benefit of claimants and, of course, lawyers.

Litigation funders might also be able to assist the lawyers and claimants in managing the litigation, including assisting in strategic and tactical decisions by bringing a highly commercial and objective perspective to assessing a claim. The funder’s role can assist in the efficient management of a claim by ensuring that the focus is kept on the real issues in dispute and by seeking to avoid time and costs being spent on the pursuit of claims that are weak or unnecessary.

Litigation funding and the rule of law

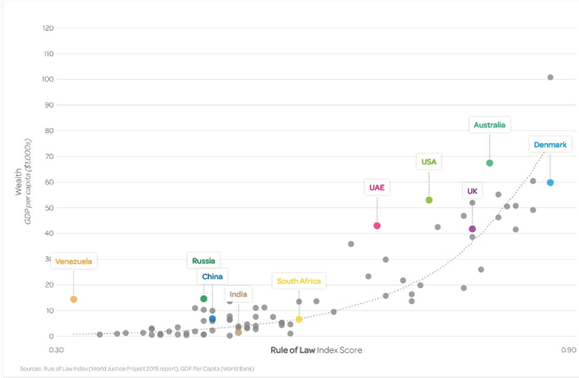

Effective rule of law creates many benefits to a society – it helps to tackle corruption, poverty, and helps to protect people from various injustices. Without the rule of law, individuals and businesses cannot enforce contract, secure property rights or obtain effective redress against other individuals, enterprises, or the state. Inadequate enforcement of regulations, high presence of corruption, insecure property rights, and ineffective means to settle disputes destabilise legitimate business and discourage both domestic and foreign investment. The rule of law can thus have a deep impact on the fairness and prosperity of a society.

The graph below confirms that there is a strong positive relationship between GDP per capita and the rule of law index, which is based on factors related to constraints on government powers, absence of corruption, open government, fundamental rights, order and security, regulatory enforcement, civil justice, and criminal justice.

The rising costs of litigation has made such access to justice excessively expensive for many claimants. Cuts to legal aid have worsened the picture. Litigation funding helps to improve access to justice and ensure the rule of law.

Alternative funding models and future developments

There is considerable innovation within the funding sector. While large litigation funders are typically backed by institutional capital and are thus forced to adhere to strict investment criteria, platform-centric litigation funders (such as Lexshares and AxiaFunder) source capital from a large pool of professional, high-net-worth retail investors and are thus able to offer a more flexible low-cost funding solutions to both claimants and solicitors. This is possible since platforms offer more risk-sharing across a wider number of investors – just as the valuation of a company on the stock market will tend to increase as the investor base becomes more diversified.

Platform funders can also be more flexible when it comes to the case selection process itself, potentially funding higher-risk claims or claims that might take longer than usual to resolve, such as cases in international jurisdictions, as long as the transaction pricing is attractive to platform investors.

Many lawyers, often considered to be a relatively cautious group, have been slow to embrace litigation funding and in particular a platform funding approach. This is not without justification; litigation often revolves around sensitive and privileged information. Platform funders need to ensure that investors sign NDAs and confirm that they are not conflicted in a way that could prejudice the claimant.

Litigation funding helps to improve access to justice and ensure the rule of law.

Also, while investor demand for litigation assets on platforms is typically very strong, there is a degree of uncertainty regarding whether the funding will be successfully sourced and how long it will take. Some platforms have addressed this by putting backstop underwriting capital in place, much as an investment bank will sometimes underwrite a company IPO.

Funding a case via a platform or otherwise has another dimension. While the details of the case are typically kept confidential, for some cases it may be appropriate to use the funding process to apply reputational pressure on the defendant. Clearly the platform model has an advantage in this respect.

Funders today can profitably fund smaller cases by taking advantage of the latest digital collaboration tools and the trend towards decentralised working that accelerated during the COVID-19 pandemic. Evidencing this, at one point last year our own small team was collaborating very effectively while distributed in the UK, Spain, and Greece.

In addition, traditional litigation funders typically restrict their activities to funding legal costs only. New funders are often able to provide funding for a more flexible use – for example, preliminary or seed funding to claimants (e.g. to obtain a legal opinion), providing working capital and/or to reimburse previously incurred costs.

In the longer run, it seems inevitable that the blockchain and NFTs (Non-Fungible Tokens) will grow rapidly, with litigation funding a clear use case. Law coin and Liti Capital are examples of two companies focused on this. We also expect litigation funding to evolve into more of a stock market model, whereby law firms with meritorious cases can structure them with external assistance, into an investable security – in effect IPO-ing the litigation funding opportunity. This can be done on a single-case basis or in a portfolio format. The result will be a larger pool of available capital.

[ymal]

Summary

Despite the benefits, we are in the early innings for the sector and litigation funders are still not perceived positively in many countries. In France, for example, litigation funders are seen as greedy capitalists. In Ireland and many US states, litigation funding is perceived as a perversion of the legal system. This stems from behaviour in medieval times where feudal lords would fund many frivolous cases to upset a rival.

Nevertheless, litigation funding is likely to become more conventional as the market continues to grow and develop. In countries where the litigation funding market is more developed, an increasing number of market players and competition between them results in more competitive pricing for claimants. In the very long run, just as a police force can boost law and order, the presence of funding capital will make deep-pocketed defendants think twice before acting in a way that leads to litigation, which is clearly a positive outcome for society in general.

Cormac Leech, CEO

Diana Pupkevic, Investment Analyst

AxiaFunder, 184 Shepherds Bush Rd, London W6 7NL

Tel: +44 203 286 5922

Cormac Leech has focused on the alternative finance space for the past seven years. He was closely involved in raising over $2 billion for direct lending funds as a founder and director of the Liberum Alternative Finance, and also incubating several fintech startups. He has also been a senior consultant to private equity groups including VPC after spending a number of years in strategy consulting at McKinsey.

Diana Pupkevic has previously completed internships at ING and British Business Bank supporting the organisation’s strategy in reducing regional imbalances in SME access to finance. Diana holds an MA in Comparative Business Economics from University College London and a First-Class Honours degree (BA) in Business Economics from University of Greenwich. She is also fluent in both Russian and Lithuanian, and has volunteered for a year at XLP, a mentoring project working with young people in disadvantaged communities in London.

AxiaFunder is a UK-based litigation funding platform which offers investors direct access to pre-vetted commercial litigation investment opportunities that it expects to offer attractive risk-adjusted returns. Similarly, claimants with meritorious claims can access capital through the AxiaFunder platform, enabling their cases to progress.