COVID 19: a game-changer

Sometimes events can be as unprecedented as what happened from March 2020 from a business perspective. Businesses across the world faced lockdowns, falling revenues and sales, unpaid bills and new ways of remote working for staff. Everywhere, it was the small and medium-sized companies that were the most exposed and affected.

From 2021 supply chain problems and shortages of materials affected the global economies. Rising inflation (with exploding gas and electricity prices) next to exploding real estate prices seem to be becoming the economic trend in 2022. Secondly, the expected interest rate rise — on which no one really dears forecast the effect on the global economies — seems to be the second issue (apart from geopolitical economic factors like international crises).

Although the pandemic wasn’t bad news for everyone. Companies that had invested in technology fared better and in some cases business boomed like the pharmaceutical sector. Elsewhere, many firms in all sectors were quick to adopt new technology models for business operations, which included the use of mobile meeting apps, file sharing and using online apps and channels for sales, service delivery and marketing. The office real estate sector changed for good since homework will stay.

No bottomless state aid

To help companies survive the crisis, governments unveiled packages to help endangered businesses, trying to provide damage limitations to their economies. In Belgium, the government unveiled a 34 billion euro package of state aid to help businesses. Legal professionals working in the insolvency sector in all jurisdictions suddenly had to keep up with new legislation being rushed through by different governments in an attempt to adapt their legislation to the pandemic challenges and to try to prevent their companies from going illiquid or worse, bankrupt, with even greater economic damage for the country and jurisdiction as a result.

The Belgian professional’s view

In Belgium, companies can rely on the procedure of judicial reorganisation (the former “WCO”) and as a result of its suspension, there is a period of protection offered. They can apply for a judicial reorganisation. The company then will be assisted further under the assistance of the court in which their assets will be sold to the public market under the responsibility of the Commercial Court. Distressed companies were given the possibility of making silent plans with their assets transferred to other market players, for example, competitors in order to pay the companies creditors. This is under the surveillance of the commercial court-appointed trustee.

These changes to the law were designed to help businesses that had been impacted by the COVID crisis to continue trading, giving them time to explore options for rescue or restructuring. While Belgium is at the end of its Covid- 19 restrictions, the government is trying to keep as much of the economy going as possible. However, from my perspective as a bankruptcy receiver, some sectors have experienced severe problems such as restaurants, bars, hotels and retail shops. Due to the supply chain problems and ongoing inflation production companies are getting more and more in distress for the moment. In terms of receiverships (there were very few bankruptcies in the period 2020 - 2021 because it was prohibited to start a bankruptcy claim in Belgium against a company that was closed due to the effects of coronavirus) we now see a rise in the number of bankruptcies form half of February 2022 and expect more bankruptcies in 2022 since all moratoria have been ended by government and all grace periods for payment of social and tax debts will also end after an initial period of 2 years after the start of the pandemic by March 2022.

2022: What are the trends?

We now see a trend where companies who survived the last two years are now getting into payment difficulties and are difficult to be rescued by the existing corporate rescue statutes. Most of those companies really have gone very illiquid with no further cash reserves and the government is no longer willing to support them after the previous 36 billion euro cash injection.

For the moment, it’s still quiet in bankruptcy, but we see difficult Chapter 11-like reorganisation files since these distressed companies have no more cash reserves in a rising inflation market. We expect that when interest rates rise even more, companies could get distressed and that it will get busier from the bankruptcy professional’s point of view.

Now we already assist more companies with filing bankruptcies than we did by the end of 2021 and we receive a lot of questions from interested buyers of distressed companies to assist them with transactions buying distressed companies from Chapter 11 like procedures or bankruptcies. We expect this trend to stay and rise in 2022.

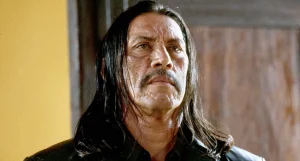

About the author: Philippe Termote is an experienced partner with a demonstrated history of working in the law practice industry and specialising in company and insolvency law. Skilled in litigation and negotiation after a general Master in law, European law, corporate law and insolvency law. Skilled with a Master class in Fraud auditing from Universiteit Antwerpen and a Master in Corporate Finance from KU Leuven. A strong entrepreneurship professional as co-founder of Agio Legal and active as a day to day business sparring partner for entrepreneurs. Philippe is a committee member of IR Global, a UK-based Legal 500 rewarded international network of Lawyers. As the only Belgian member of the network specialising in Insolvency law, he has extensive experience in cross-border insolvency cases. As a committee member of the IR Global Insolvency Team, he follows the international and cross-border trends in insolvency law.