EIP partner Gareth Probert examines the data and what it indicates for global IP in this special feature.

Each year, the European Patent Office (EPO) releases its Patent Index report outlining patenting activity on the continent. While this is always of interest to professionals in the intellectual property (IP) space, this year’s report bears reading across sectors for what it says about the state of innovation not only in Europe but globally.

In short, it is positive reading; after a couple of years of disruption, patenting activity is continuing to grow as companies find new ways of tackling the problems we are facing in Europe and beyond. While the growing number of patents filed by non-European tech giants is significant for certain industries, it is largely counterbalanced by the strong performance of Europe’s own start-up scene.

On the Road to Recovery

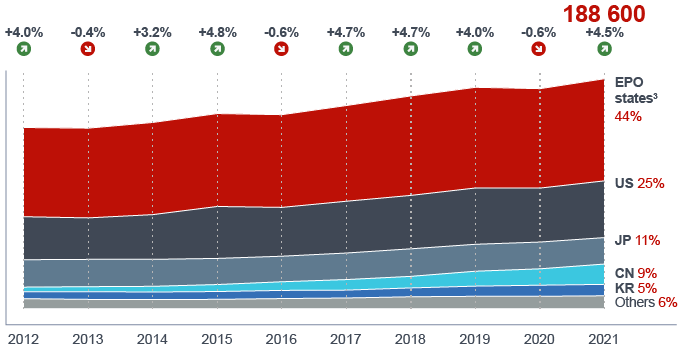

With over 4,200 patent examiners, the EPO handles a huge number of applications each year from individuals, universities, and companies from all around the world. In 2021, a total of 188,600 applications were filed at the EPO, which includes new applications filed directly at the EPO, applications derived from International (PCT) patent applications and divisional applications derived from existing European applications. Amazingly, this means that roughly 700 applications are received by the EPO every working day!

After a slight drop in numbers in 2020, filings have rebounded with a more typical increase of 4.5% in 2021, partly driven by the unique conditions of the COVID-19 pandemic.

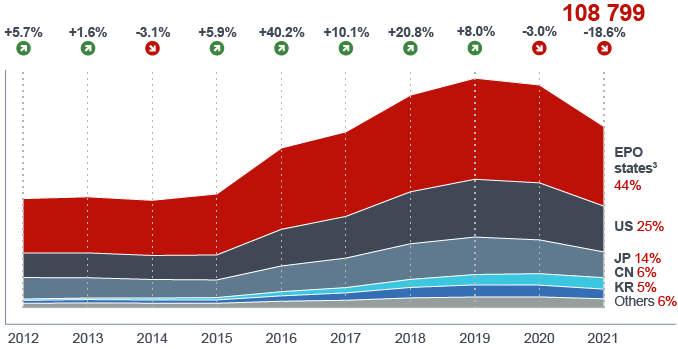

Looking at these numbers alone can be misleading, as applications can be filed for many reasons and with varying chances of being successfully granted. So, to gain some perspective it is important to also have a look at the number of patents being granted by the EPO. There is of course a delay of a few years from filing to grant, but there are clear trends visible in the new statistics regardless.

Users of the EPO are familiar with the management’s drive to increase perceived efficiency and timeliness, and the aim to reduce the backlog of cases (euphemistically called “stock” by the EPO). It seems that this ambition has led to a dramatic increase in the number of cases being granted from 2015 onwards, with examiners being encouraged to dispose of older applications more quickly. However, this activity peaked in 2019 with 137,784 European patents being granted and has dropped since then to a total of 108,799 patents being filed in 2021. Much of this could be the result of COVID-related disruptions to normal working patterns, meaning next year’s granting figures will tell us much more about how the EPO has adapted to home working for examiners.

Blurring of Technical Fields Continues

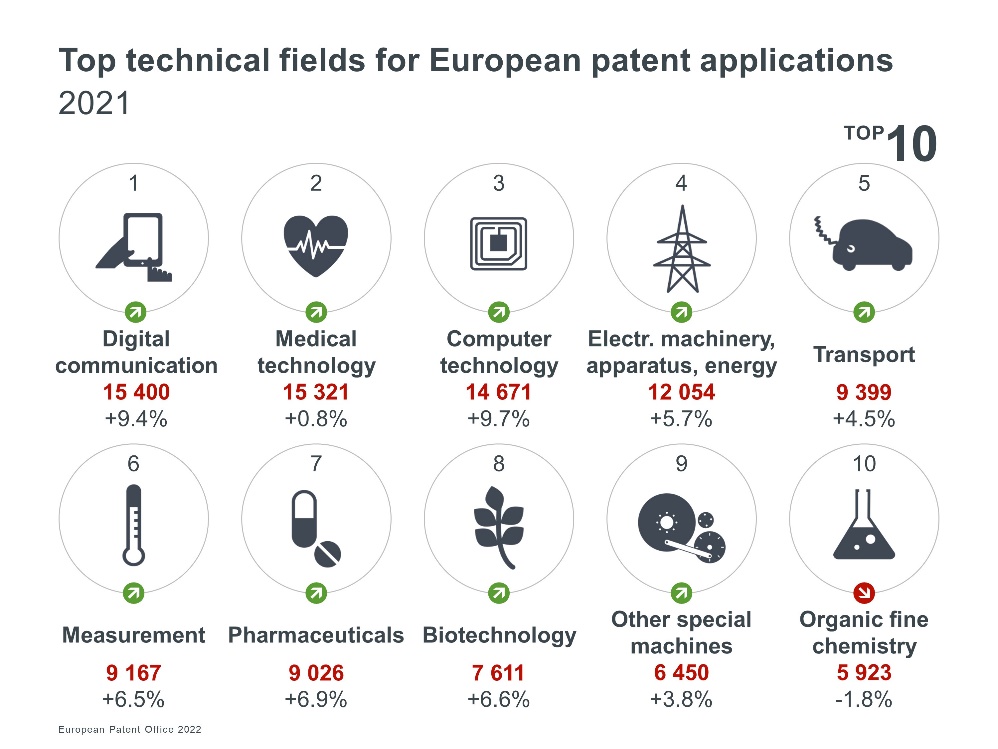

Medical technology has been the sector with the most applications for most of the last decade according to the EPO, with digital communications running a close second. In 2021, digital communications finally claimed the spot as the most popular technology with 15,400 applications, just 79 more than medical technology. Applications involving computer technology are not far behind, showing continued growth over recent years.

These statistics must be seen as a rough indication, however, as innovations are becoming more interdisciplinary over time. Many applications are based on combinations of traditionally separate technologies. For example, 5G technology allows medical devices to connect to each other and networks to enable the Medical Internet of Things (MIoT). The EPO statistics would perhaps classify such a medical device as either “digital communication” or “medical technology” depending on the examiner’s view of the most relevant technology claimed in that specific patent application. It may be difficult to achieve, but a more nuanced analysis of the technologies of new innovations would be extremely valuable to all parties. More detailed data could highlight what combinations of technology are giving rise to modern inventions.

Pharmaceutical and biotech applications saw some growth in 2021, but perhaps not as much as expected given the need to tackle the global pandemic. However, many of the mRNA platform technologies underpinning the COVID-19 vaccines had been developed and protected in previous years. There were huge efforts to develop effective vaccine platforms to tackle the SARS, MERS, Ebola and Zika outbreaks in recent years, and many of the COVID-19 vaccines were able to build on this existing knowledge base.

After a couple of years of disruption, patenting activity is continuing to grow as companies find new ways of tackling the problems we are facing in Europe and beyond.

The Origin of Patents

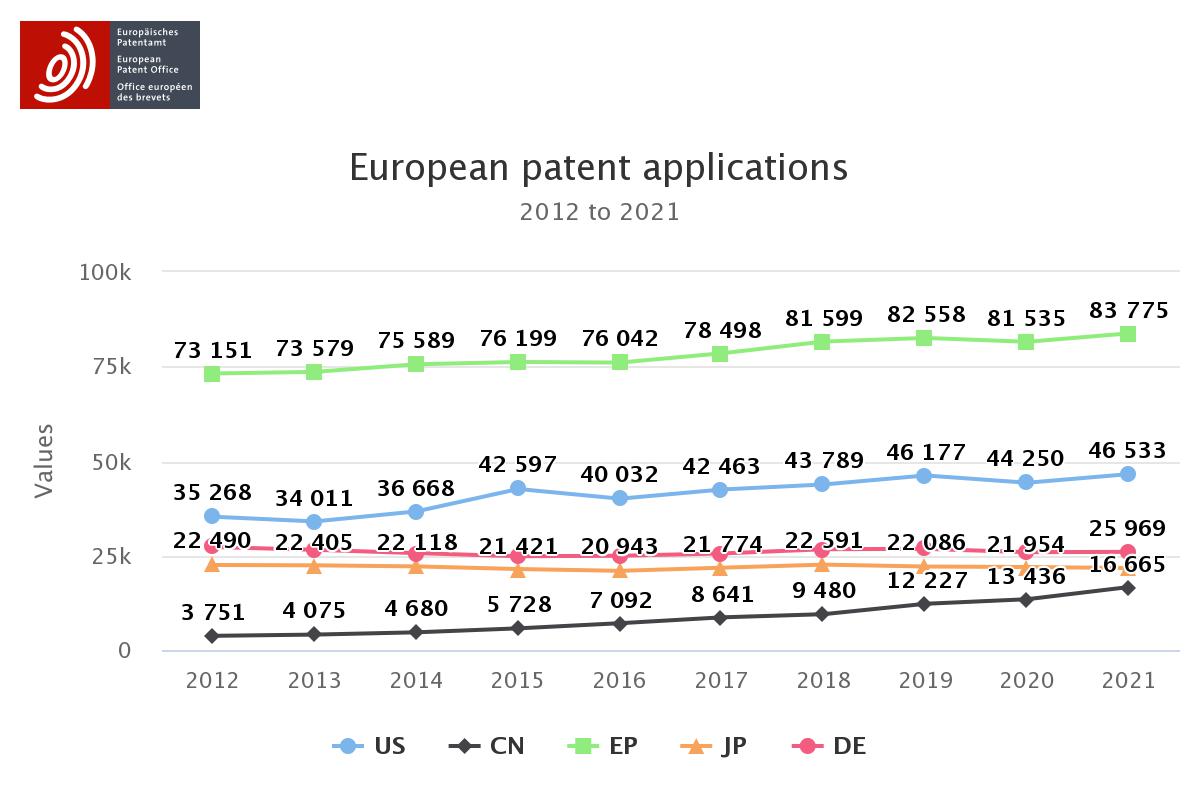

Another way of slicing the data is by the originating country of the applicant. This is useful, but again blurs some details, especially where there is more than one applicant or if a company’s headquarters is in a different country from where the research is carried out. Applicants in the EPO member states are the biggest filers yet again, with 44% of all applications filed. Although the official statistics place the US in second place with 25% of cases, it is in fact the single country with the largest number of applications, ahead of EPO-member Germany with 14%.

Japan continues to be represented with a steady 11% of cases, but China is closing fast. Over the past decade, economic and technological growth in China coupled with government incentives has resulted in increasing number of applications at the EPO. The 24% increase going from 2020 to 2021 is remarkable and may lead to China surpassing Japan and perhaps Germany in the next couple of years.

The last way to view the data is by the applicants themselves. Again, there is uncertainty resulting from cases with multiple applicants, different companies within a group and from how the names of companies are entered onto the EPO register. For several years the same three companies have jostled for position of the most prolific filer at the EPO, namely Huawei, Samsung, and LG. After Samsung took first place last year, Huawei have returned to the top spot with an astounding 3,544 application filed in 2021, with LG keeping their third place. Notaby, Huawei is responsible for about a fifth of all applications originating from China.

Diverging Strategies

Whilst the performance of Huawei, Samsung and LG is impressive (not least in terms of the hours spent in writing all those specifications), there are differences in filing strategies in different sectors and companies. The value of a single application to a global telecommunications giant may be very different compared to a start-up based on a new technology.

It may be more interesting to look at the tail of smaller portfolios for SMEs rather than the top ten applicants. While 75% of all European applications come from large enterprises, an impressive 20% originate from SMEs and individuals (with 5% coming from universities).

It is my experience that many of these SMEs are developing interdisciplinary products and processes that have the potential to be disruptive to existing companies. Also, these smaller companies can be dependent on government grants and investor funding, especially if they are tackling environmental or climate-related problems.

[ymal]

In amongst these cases are technologies underpinning vaccines, diagnostic tests, videoconferencing, collaborative working, automated vehicles and batteries, all of which have become increasingly present in our lives. At my own firm, we see these fascinating new technologies as we help companies to identify, protect and enforce their IP in Europe.

All in all, things are looking good for the wider European patenting landscape. After a slight pause, more applications than ever are being filed across the continent. The encouraging patent data also shows that the EPO has adapted well to the new normal of remote working and videoconference hearings. Innovative companies around the world are keen to protect their IP in Europe, and the EPO continues to meet that challenge.

Gareth Probert, Partner

EIP, Fairfax House, 15 Fulwood Place, London WC1V 6HU

Tel: +44 020 7440 9510

Fax: +44 020 7117 5111

Gareth Probert is a partner at EIP and an IP lawyer with over 20 years of experience, having represented clients in many opposition and appeal hearings at all levels of the European Patent Office. Over the past 10 years, he has held senior positions at two leading IP firms and is now head of the EIP HealthTech practice group. Protecting innovations in the medtech and healthcare sectors.

EIP is a leading intellectual property firm comprising patent attorneys, litigators and commercial IP lawyers based in Germany, the UK and the USA. The EIP team advises on high-value and complex patent matters and is highly ranked across all six technology sectors in Europe's Leading Patent Law Firms 2022.