Understand Your Rights. Solve Your Legal Problems

CERP Rhin Rhône Méditerranée (CERP RRM) is the 4th largest French pharmaceutical distributor and with CERP Rouen as the 2nd this merger connects two big players in the industry. The group now has a market share of 32.5% representing almost 8 billion euros in turnover.

The new entity is called CERP and governed under the joint control of Astera and CERP RRM.

CERP Rouen accepted legal support from Valoris-Avocats throughout this merger.

Valoris-Avocats were legal advisors to CERP Rouen, Luc Julien Saint-Amand worked on this project.

Valoris-avocats has been advising Astera / CERP Rouen for 20 years. The pharmaceutical distribution sector in Europe is subject to numerous mergers, with the Phoenix Mac Kesson merger in 2022 creating the largest player in France. Faced with this concentration, the directors of CERP Rouen and CERP RRM decided to join forces.

With my team at Valoris Avocats, we looked at the legal structure of such a merger, because although Astera and CERP RRM are majority-owned by pharmacists, Astera is a cooperative company, while CERP RRM is a commercial company - two models governed by different legal rules that had to be made compatible.

We started with the design of the project by submitting various possible scenarios to the management. The essential thing was to combine the strengths of the two companies while retaining their spirit and culture, i.e. a global offering of pharmaceutical distribution and services by pharmacists for pharmacists.

A merger was not possible because of the different legal regimes, which is why the option of a contribution of the branch of distribution activity was chosen. This approach was put to the CEOs, to the boards of directors, to staff representatives and trade unions. All were convinced of the merits of this project and its procedures and approved it. The merger was subsequently approved by the competition authorities.

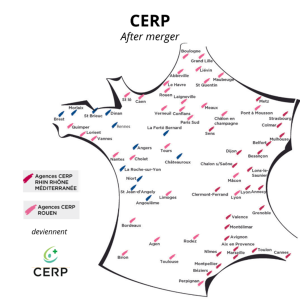

With this merger, CERP not only becomes number 2 in France, but also covers almost the entire country. At a time when national pharmacy groups are expanding, CERP can now offer a nationwide service. What's more, the close-knit culture of the two entities, which have been part of the French landscape for a century, means that their teams are able to work very effectively together.

Valoris Avocats as well as Chaintrier avocats advising CERP RRM and represented by Arnaud Moquin, worked very closely with the teams at both CERP Rouen and CERP RRM throughout the merger process. Pharmacists who are customers of CERP RRM have been invited to become members of the Astera cooperative; conversely, pharmacists who are members of Astera have been invited to become shareholders of CERP RRM. The pharmaceutical distribution sector is essential to public health, and regulations are constantly changing. All these aspects augur well for continued cooperation in the future, in line with the cooperative and confraternal principles valued by CERP. CERP will have to continue to adapt, to be agile, and perhaps to move forward with other mergers. Valoris Avocats will be delighted to be at its side.

"In my entire career, this merger has been the most relevant and constructive I have ever experienced: very little duplication, a complementary geographical area and a very similar culture, managers with equally complementary profiles working as a team. CERP is set for great success."