Qatari Royal Dispute Unveiled in High Court Battle Over £21M Diamond.

A dispute within a royal family regarding a valuable diamond, potentially worth up to £21 million, is headed to the High Court for resolution. Members of Qatar’s wealthy Al-Thani dynasty are at odds over the Idol’s Eye, believed to be the largest cut blue diamond in the world. This 70-carat gemstone, dating back to the 17th century, was discovered in India in 1600 and was previously owned by an Ottoman Sultan.

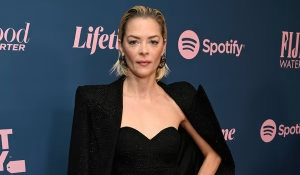

Sheikh Hamad bin Abdullah is fighting the late Sheikh Saoud’s widow and children for the diamond

After World War II, it was incorporated into a necklace featuring 86 other diamonds. Currently, the diamond resides in the London home of the late Qatari culture minister, Sheikh Saoud bin Mohammed Ali Al-Thani, who purchased it in the early 2000s and passed away in 2014. Just before his death, he lent the Idol’s Eye to Qipco, an investment firm owned by art collector Sheikh Hamad bin Abdullah Al Thani, a cousin of Qatar’s ruler.

Sheikh Hamad bin Abdullah, who reportedly owns Dudley House in Mayfair, valued at $400 million, asserts he has the right to acquire the diamond for $10 million (approximately £7.8 million). The loan agreement allegedly provided him the option to purchase the diamond with the approval of Elanus Holdings, the company managing the estate of Sheikh Saoud’s widow and children. However, the two parties disagree on the diamond's valuation and whether a sale agreement was ever established.

Qipco contends that the sale process began in 2020 with a letter from Elanus’ Swiss attorney, which indicated that the family wished to sell the Idol’s Eye. Qipco claims it proceeded with the sale, but the late Sheikh’s family retracted their offer, which they argue violates the loan agreement. They are requesting the court to compel Elanus to sell the diamond for $10 million, which aligns with a previous high valuation by Christie’s.

Elanus' legal team claims it was an error to interpret the letter as a sales offer, asserting that it did not express the company's desire to sell the diamond. The High Court was informed, "While the letter dated February 6 mentioned the family's intention to sell the Idol's Eye, that was not the case." They emphasized that there had been no discussions or considerations regarding the sale. Furthermore, Elanus and its ultimate beneficial owner, the Foundation, had not been consulted at all, much less expressed any desire to sell.

Ed Sheeran Accuses Band Aid of Using His Vocals Without Permission on New Mix

Elanus explained that the letter was sent after the late Sheikh's son contemplated selling the diamond to finance property investments. They also contend that the gem's value could exceed $10 million, referencing a valuation of £21 million from an Elanus diamond expert. In contrast, Qipco's attorney argued that Elanus had indeed developed a firm intention to sell and that their Swiss lawyer had clear authority to send the letter. The lawyer maintained that the solicitor received an "unambiguous instruction" to draft "a formal letter on behalf of Elanus to inform Qipco of our desire to sell the Idol's Eye." Qipco countered that the higher valuation from Elanus' expert was merely an effort to inflate the sale price.

The hearing is ongoing.