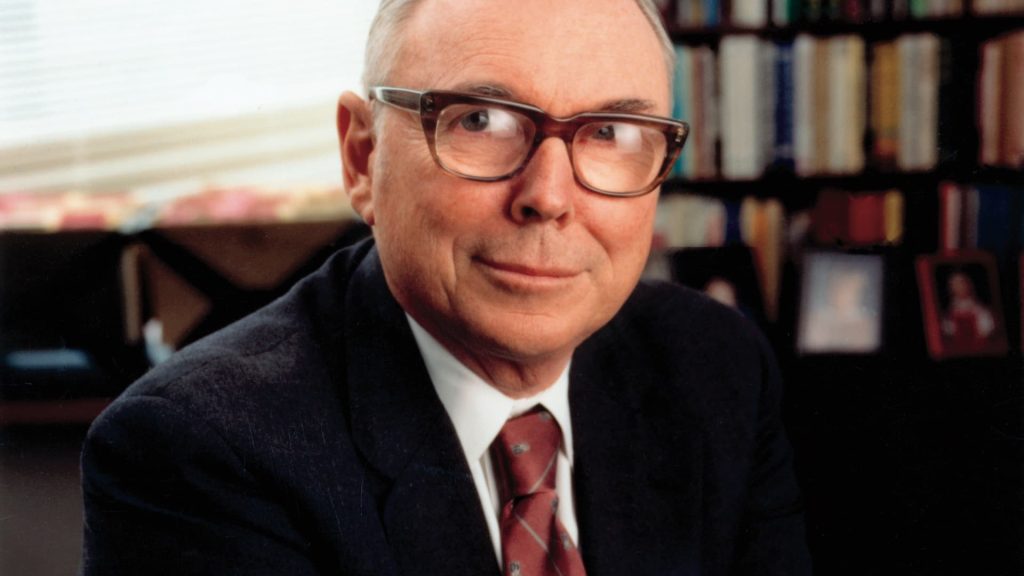

Charlie Munger - Who was Lawyer turner Billionaire Investor?

Charlie Munger was an American billionaire investor, businessman, and philanthropist best known for his role as the vice chairman of Berkshire Hathaway, the multinational conglomerate headed by Warren Buffett. Munger was widely regarded as one of the most successful investors of his generation and had a significant influence on the world of finance and investing.

Early Life and Education

Born on January 1, 1924, in Omaha, Nebraska, Munger’s early life shaped his future success. He attended the University of Michigan, where he studied mathematics, before serving in the U.S. Army Air Corps during World War II. After the war, Munger attended Harvard Law School, where he earned his law degree without completing an undergraduate degree, an impressive feat at the time.

Munger’s early career was in law, but he soon became fascinated by investing and business. He left his law practice to pursue a career in finance, beginning to invest in real estate and stocks. His partnership with Warren Buffett started in the late 1950s, and the two quickly became close friends and business partners.

Career and Investment Philosophy

Munger’s investment philosophy was often seen as complementary to that of his longtime friend and business partner, Warren Buffett. While Buffett was renowned for his value investing approach—buying undervalued companies with strong growth potential—Munger’s strategy was more eclectic and diversified. He encouraged looking beyond the conventional to understand businesses and industries deeply, advocating for what he called a "latticework of models," meaning the use of various disciplines (economics, psychology, history, etc.) to make better investment decisions.

Munger’s approach was heavily influenced by his interest in mental models and human behaviour. He believed in the importance of rational thinking and the avoidance of common psychological biases that often affected investors' decisions, such as confirmation bias or loss aversion. His famous phrase, "invert, always invert," reflected his belief in solving problems by considering the opposite or by approaching them from a different perspective.

One of Munger’s most famous investments was in See’s Candies, a company Berkshire Hathaway acquired in 1972, which has since been a key contributor to the company’s overall success. Munger was known for his direct and candid opinions, which were often delivered with sharp wit and humour, making him a respected figure both within the finance world and beyond.

Role at Berkshire Hathaway

Munger’s role at Berkshire Hathaway was central to the company's success. As vice chairman, Munger worked alongside Buffett, contributing to the company's investment decisions and its overall business strategy. While Buffett was the face of Berkshire Hathaway, Munger’s input was invaluable, and his influence extended to the company’s corporate culture, which was characterised by a long-term, value-driven approach to business.

Munger was also instrumental in Berkshire Hathaway’s acquisition strategy, focusing on acquiring businesses with strong brands, competent management, and a predictable future. Under their joint leadership, Berkshire Hathaway grew into one of the largest and most successful companies in the world, with holdings in diverse sectors such as insurance, railroads, energy, and consumer goods.

Law Career and Transition to Investing

Before becoming the renowned investor and business magnate, Charlie Munger had a notable career in law. After graduating from Harvard Law School in 1948, Munger initially pursued a legal career, practising law for a number of years in California. His legal background would later influence his investment philosophy, particularly his focus on rational decision-making and avoiding psychological biases.

Munger’s path to law was not traditional. Unlike many lawyers, he did not earn an undergraduate degree before entering Harvard Law School. Instead, he was admitted to law school after serving as a meteorologist in the U.S. Army Air Corps during World War II. Despite the lack of a formal undergraduate degree, Munger excelled at Harvard, graduating with a law degree in 1948.

Following his time at Harvard, Munger worked as a lawyer in California. He first practised law at a law firm in Los Angeles before founding his own firm, Munger, Tolles & Olson, in 1962. The firm gained a reputation for its work in corporate law, particularly with clients in the real estate and investment sectors. Munger’s legal work included real estate transactions, mergers, acquisitions, and general corporate advice.

While he was successful in his law career, Munger’s interests shifted toward investing. His legal expertise, however, provided a solid foundation for his later success as an investor. The skills he developed in legal analysis, negotiating deals, and structuring transactions played a pivotal role in his investing career.

Transition to Investing

Munger’s transition from law to investing began in the 1950s when he started making personal investments in the stock market. Initially, he practised law while gradually shifting his focus towards the world of finance. Munger was particularly drawn to value investing, a strategy that involves purchasing undervalued companies with strong long-term prospects. His interest in investing led him to meet Warren Buffett, with whom he would form one of the most successful business partnerships in history.

While his law career was lucrative and respected, Munger’s true passion lay in investing. He eventually left his law firm to become more involved in business and investing, and this decision proved to be pivotal. His legal background, with its emphasis on logical reasoning and thorough analysis, influenced his investment philosophy and set him apart from other investors who may have been more focused on short-term gains.

Personal Life and Philanthropy

Outside of his business activities, Charlie Munger was a philanthropist, donating large sums of money to various causes, particularly in education and science. He was a major donor to the University of Michigan, Harvard Law School, and the California Institute of Technology (Caltech), reflecting his belief in the importance of intellectual development and education.

Munger was also known for his love of reading, a habit he credited with much of his success. He was often quoted for his advice on the importance of lifelong learning, famously stating, "The best thing a human being can do is to help another human being know more." He wrote extensively on topics such as investing, decision-making, and mental models, sharing his wisdom with the public through speeches and interviews.

Munger’s personal life was marked by his love of architecture and the arts. He was married twice and had several children, though he remained a relatively private figure in his personal affairs.

Legacy and Influence

Charlie Munger’s legacy is one of intellectual curiosity, rationality, and long-term thinking. His influence on the world of investing was profound, with many investors and business leaders citing him as a mentor or inspiration. Munger’s ability to think independently, focus on high-quality investments, and avoid the pitfalls of speculative behaviour made him a respected figure in the world of finance.

At the time of his passing, Munger had contributed significantly to Berkshire Hathaway and the world of business, continuing to play an active role in the company’s strategy. His sharp wit, profound wisdom, and unconventional thinking cemented his status as one of the most important and influential figures in modern finance.