Charlie Munger’s Wisdom: The First $100,000 Is the Hardest – Then Wealth Snowballs.

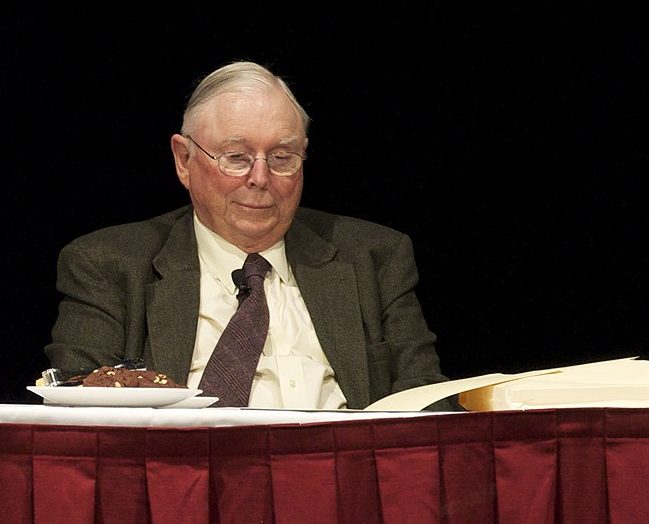

Building wealth is a goal many aspire to, but getting started can seem daunting. Charlie Munger, the billionaire vice chairman of Berkshire Hathaway and Warren Buffett’s trusted right-hand man, always emphasized that the toughest part of accumulating wealth is reaching that first $100,000. This milestone, according to Munger, is the true challenge that all investors must conquer before they can sit back and let their money work for them.

Munger, who passed away just shy of his 99th birthday, frequently shared financial advice that continues to resonate with investors today. One of his most quoted insights was from a 1990s Berkshire Hathaway shareholder meeting, where he famously said, “The first $100,000 is a bitch, but you gotta do it.

I don’t care what you have to do – if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000. After that, you can ease off the gas a little bit.” This straightforward advice highlights the difficulty of building wealth from the ground up. Without the advantages of compounding or significant returns, the early stages are challenging.

Latest: Jeff Bezos Awards $50 Million Grants to Eva Longoria and Admiral Bill McRaven

Munger elaborated on this concept in the book Damn Right!: Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger, explaining that wealth-building is akin to rolling a snowball. “It helps to start on top of a long hill – start early and try to roll that snowball for a very long time,” Munger said. The first $100,000 is the most difficult part of this process, but once you get past that milestone, wealth-building accelerates significantly.

Why Is the First $100,000 So Hard?

Munger's focus on this number is due to the importance of the compounding effect. Before reaching the $100,000 mark, your wealth depends almost entirely on your savings. Once you cross that threshold, however, you can begin to rely on compounding returns to accelerate your wealth. Consider the following example:

- If you invest $100,000 and earn a modest 7% annual return, that's $7,000 in gains – all while doing nothing.

- If you reinvest those returns, your wealth continues to snowball, multiplying over time.

This compounding effect is why building wealth becomes easier after you hit that first $100,000. Every additional dollar you earn generates more returns, and as your net worth grows, your rate of wealth accumulation increases.

The Tipping Point

But why is the first $100,000 such a pivotal number? Because that's when the compounding starts to really take effect. Below this amount, every dollar you earn must come from your paycheck. However, once you have $100,000, your wealth begins to grow without your direct intervention. This is when the financial snowball starts to roll faster, and the path to further wealth becomes clearer.

Beyond the financial aspects, there’s a psychological transformation as well. Once you reach this level, you see the proof that wealth-building is possible. This proof encourages continued discipline, smart budgeting, and staying committed to long-term investments. Munger's approach is about perseverance: the first steps may be hard, but once you gain momentum, the process becomes much easier.

A Look Ahead: The Long-Term Journey

While the first $100,000 is undoubtedly the hardest hurdle, the path to even greater wealth can be achieved through smart investments and strategic planning. As technology and the stock market evolve, opportunities to compound returns continue to grow, with investors having more access to diverse asset classes such as real estate, cryptocurrencies, and global equity markets.

The future of wealth-building is increasingly about taking a long-term perspective and using compounding to your advantage. Many experts suggest leveraging tax-efficient investment vehicles like 401(k)s, IRAs, and other retirement accounts to maximize compounding. Additionally, younger investors can start early, letting time work for them and benefiting from higher returns as they grow their portfolios.

Related: Charlie Munger - Who was Lawyer turner Billionaire Investor?

Furthermore, a diversified approach to investing is important to guard against market fluctuations, and investors are increasingly seeking out opportunities in emerging technologies, green energy, and biotechnology, among other sectors. With greater access to financial tools and knowledge, wealth-building strategies have become more refined and accessible to a broader range of individuals.

In the end, Munger’s advice remains timeless: starting from scratch is the hardest part, but once you reach that first milestone, the path to wealth becomes easier to navigate. Focus, save aggressively, and understand that the snowball effect is what makes long-term financial independence a reality.