Wall Street Meltdown: Trump's Tariff Sparks Hedge Fund Bloodbath.

Hedge funds are facing Lehman-style margin calls as a market crash triggered by President Donald Trump's tariffs raises fears of a looming 'Black Monday.'

The significant decline in the market has compelled hedge funds to liquidate assets, with prominent Wall Street banks requesting additional collateral following a sharp decrease in the value of their holdings, according to insiders.

There is growing apprehension about a recurrence of the catastrophic 'Black Monday' that occurred on October 19, 1987, when the Dow Jones Industrial Average fell by 22.6 percent, marking the largest single-day percentage drop in history.

This situation arises as a 10 percent global 'baseline' tariff was implemented late last night, affecting all U.S. imports except those from Mexico and Canada. By April 9, approximately 60 trading partners, including the European Union, Japan, and China, are expected to encounter even steeper tariffs tailored to their respective economies.

Margin Calls and Market Mayhem: Hedge Funds in Freefall

In the wake of Trump's tariff disruptions, several major banks have issued their largest margin calls to clients since the beginning of the COVID-19 pandemic in early 2020. The magnitude of these calls, spanning various sectors such as technology and consumer goods, has raised alarms that the aggressive sell-off may persist into Monday. Margin calls can trigger a detrimental cycle, as selling stocks to fulfill these calls can further depress prices. On Friday, gold prices dropped by more than 3 percent, reversing earlier gains from the week, as investors were compelled to sell bullion to offset their losses.

'Rates, equities, and oil were all down significantly… it was the broad market movements that caused the scale of the margin calls,' one prime brokerage executive told the Financial Times.

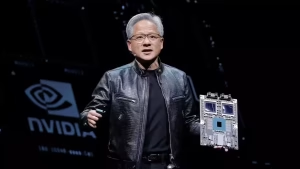

Wall Street in turmoil as Trump’s global tariff sparks fears of a financial meltdown and echoes of Black Monday.

Another executive from a different prime brokerage remarked, "We are actively engaging with clients to evaluate risk across their entire portfolios."

Sources revealed to the Financial Times that prime brokerage teams on Wall Street, which provide financing to hedge funds, convened emergency meetings on Friday to address the rising number of margin calls. According to a recent report from Morgan Stanley's prime brokerage division, Thursday represented the worst performance for US-based long/short equity funds since tracking began in 2016, with the average fund experiencing a 2.6 percent loss.

Tariff Shockwave: Global Trade Tensions Ignite Wall Street Crisis

The scale of the selling in equities on Thursday matched some of the largest recorded declines. The report also indicated that equity positions were reminiscent of those observed during the US regional bank crisis in 2023 and the market sell-off triggered by COVID-19 in 2020. The overall market decline, particularly affecting the technology and luxury consumer goods sectors, has exacerbated the situation. As a result of the intense selling pressure, the net leverage of US long/short equity funds—reflecting the extent to which hedge funds borrow to amplify their investments—fell to an 18-month low of approximately 42 percent, as reported by Morgan Stanley.

However, experts believe the damage could have been worse if hedge funds hadn't already started scaling back stock positions and cutting leverage in response to the ongoing trade war threats from the Trump administration.

In a further sign of tension within the hedge fund industry, gold, which is generally regarded as a safe haven for investors, experienced a decline of 2.9 percent on Friday, despite the widespread market negativity.

The 'baseline' tariff introduced by Trump, which took effect just after midnight, utilized emergency economic powers to tackle perceived issues related to the nation's trade deficits. According to the White House, these trade imbalances were attributed to a lack of reciprocity in international relationships and other factors such as "exorbitant value-added taxes." On April 9, approximately 60 trading partners, including the European Union, Japan, and China, are expected to encounter even higher tariffs specifically adjusted for each economy.

📚 Further Reading

-

Kevin Bacon on Madoff, Loss, Love & Recovery

The actor opens up about financial loss, healing, and finding strength after the Madoff Ponzi scheme. -

Rex Heuermann Today: Shocking New Details Ahead of Trial

A chilling update on the Long Island Serial Killer case as new evidence emerges before trial. -

Hailie Deegan's Bold Move to INDY NXT

NASCAR’s rising star makes a daring shift to open-wheel racing in the INDY NXT series.