A client asks if your nutrition counseling is covered by their insurance. You pause. Not because you don’t have answers: but because the answer depends.

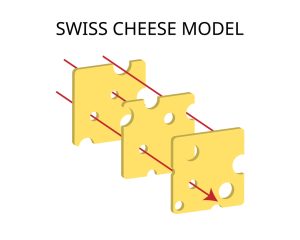

Between varying state laws and changing definitions of what counts as “medically necessary,” the legal landscape for nutrition counseling isn’t just murky - it’s shifting under your feet.

Understanding the legal and insurance angles isn’t optional. It’s the difference between scaling a trusted service and hitting a regulatory wall you didn’t see coming. Read on to find out more.

What Registered Dietitians Are Seeing on the Ground

On the clinical front, registered dietitians are often left bridging the gap between what their patients need and what insurers are willing to fund. In many cases, they're delivering complex, evidence-based care; only to see reimbursement denied because the diagnosis doesn’t meet narrow coverage criteria.

One clear example involves providers offering services like intuitive eating therapy or prenatal nutrition planning. These are deeply impactful, often necessary interventions - but they fall outside many coverage policies.

In some states, dietitians have begun appealing directly to insurers using emerging state mandates or leveraging physician referrals to push claims through under adjacent medical codes.

There’s also been a rise in demand for a private dietitian consultation, especially among patients who’ve already been denied insurance reimbursement or who are navigating multi-condition care that doesn’t align with insurance checkboxes. In these cases, patients are often better served by going directly to a registered dietitian who understands how to work within and around insurance constraints.

Dietitians have also learned to operate in what amounts to legal limbo - balancing scope-of-practice regulations, varying licensure standards across states, and insurer definitions of "medical necessity" that rarely keep up with research. Some have succeeded in getting direct billing privileges through persistence, legal coaching, or by exploiting gray areas in provider non-discrimination statutes.

Regulatory Gray Zones and Reimbursement Realities

The first challenge is that nutrition counseling doesn’t always slot neatly into existing insurance frameworks. Medicare, for instance, covers medical nutrition therapy only for a narrow set of conditions. For everything else, the default is typically no. Private insurers often mirror these limitations.

Coverage decisions hinge on statutory interpretation, not just clinical merit. Legal departments in insurance companies must translate vague language from:

- Federal mandates

- State insurance codes

- Contractual obligations

Into defensible policy terms.

The Legal Playbook Behind Coverage Terms

Negotiating what qualifies as reimbursable nutrition counseling isn’t just a policy exercise. The question isn’t whether nutrition works. It’s whether insurers can justify covering it within existing legal structures.

That justification often starts with the CPT coding system. Codes 97802 through 97804 are the bread and butter for MNT billing, but many payers restrict them to only certain ICD-10 diagnoses. Legal staff often cross-reference clinical guidelines from groups like the American Heart Association or the Academy of Nutrition and Dietetics to bolster - or block - policy expansion.

States with parity laws, non-discrimination mandates, or evolving preventive care definitions are testing grounds. For example, legislation that expands mental health coverage can indirectly force payers to cover nutrition counseling for eating disorders, creating downstream legal pressure to revisit blanket exclusions.

Evaluating Coverage Through a Legal-Clinical Framework

As payers try to realign coverage with outcomes-based care models, legal frameworks. Coverage expansion, at least in theory, becomes easier to defend when there's measurable return on investment.

This has led some insurers to rethink how they define value in preventative care; and nutrition is often an ideal test case.

A recent review of high-impact nutrition interventions found that insurers who covered counseling for conditions like:

- Metabolic syndrome

- Prediabetes

- GERD

Saw tangible reductions in pharmacy costs and hospital visits. That way, legal departments can create policy positions anchored in both regulatory defensibility and actuarial soundness.

Toward Smarter Policy Design

Policy innovation often lags behind clinical innovation, but some payers are making early moves. Tiered benefit models are being tested, where patients with certain conditions qualify for comprehensive coverage, while others receive partial reimbursement based on risk profiles. These models give legal teams the flexibility to contain costs while complying with mandates on equitable access.

States are entering the arena too. Oregon’s new bill will mandate coverage for six annual visits with a registered dietitian for patients with diet-related conditions. That state-level momentum has prompted insurers in nearby regions to preemptively review their policies to avoid sudden noncompliance risks.

A Legal Tightrope Worth Walking

Insurers now face a fork in the road: stick with rigid interpretations of coverage law and risk regulatory and reputational fallout - or invest in modernizing policy frameworks that acknowledge nutrition counseling as essential care.

Redesigning insurance coverage to align with evidence-based dietary care won’t be simple. But the legal infrastructure is there, waiting to be reinterpreted. With enough pressure, there's a better future ahead.