Pay stubs are essential in today's workplaces for both companies and workers. They include important details, including payments made, tax responsibilities, withholdings, and payment dates. However, the problem of fraudulent pay stubs is becoming more widespread, and it poses a risk to financial institutions as well as to people and organizations. The organization's stability and legal compliance depend on understanding how this type of fraud is perpetrated and how the offenders may be dealt with.

Common Types of Pay Stub Fraud

Many people resort to several tactics of paystub deception to shirk their legal responsibilities and enjoy monetary benefits. The following are some of the most common:

- Fake employers: Whole companies are set up just to create false personnel records in this kind of fraud. People who want to participate in lending, leasing, or other financial transactions frequently use it.

- False Earnings: Another common method is an alteration of bonuses, additional working hours, or even changing the compensation figures on a pay stub. Businesses may misrepresent figures to evade tax or other liabilities; similarly, employees may indulge in such practices to obtain a bank loan or credit limit beyond what their salary can comfortably support.

- Underreporting Income: Conversely, failing to disclose income is another prevalent kind of pay stub fraud that aims to garnish wages or tax obligations. The offence of employers and employees conspiring with one another to gain an advantage is to pay more than one's actual earnings with the intent to conceal one's true income.

- Overreporting Income: Certain employees might provide information that they are making more salary than they earn to convince certain financial institutions, such as credit card providers, mortgage loan providers, and other lenders. In a bid to enhance their financial standing, this class of workers also exaggerates their wages, which places the banks or lenders at risk of defaults.

The Legal Ramifications of Pay Stub Fraud

Fake pay stubs cause losses for several businesses that rely significantly on employee paystubs, such as banks, telecom providers, and advertising agencies. No matter how elaborate or harmful the apoplexy may be, faking a pay stub is considered to bear some legal responsibility. For instance, there is a chance that procedures like fabricating pay stubs might violate federal regulations like the Fair Labor Standards Act (FLSA), which regulates legal activities regarding worker remuneration. Heavy fines and possibly jail time are the penalties for breaking the FLSA's fraud reporting regulations.

Some states have less inconsistent payroll fraud rules and enjoy allowing criminals and scammers to operate with impunity. If any of the workers or employers committed false reporting, net contempt damages may be sought in a lawsuit in any tort or breach of contract action.

Companies that manage finances where employees use bogus pay stubs can sue those workers criminally as well. One such accusation is bank fraud, which involves serious punishment, such as incarceration and hefty fees.

Detecting Fraudulent Pay Stub Practices

Companies need to understand the possibility of pay stub fraud to protect themselves. Employers and those working in payroll and human resources (HR) departments should be alert for any anomalies.

The following are some red flags that could indicate the occurrence of a fraud:

- Weekly earnings statements that contain inconsistencies about overtime or monetary compensation received.

- Discrepancies between the pay paid and the alleged amount of hours worked.

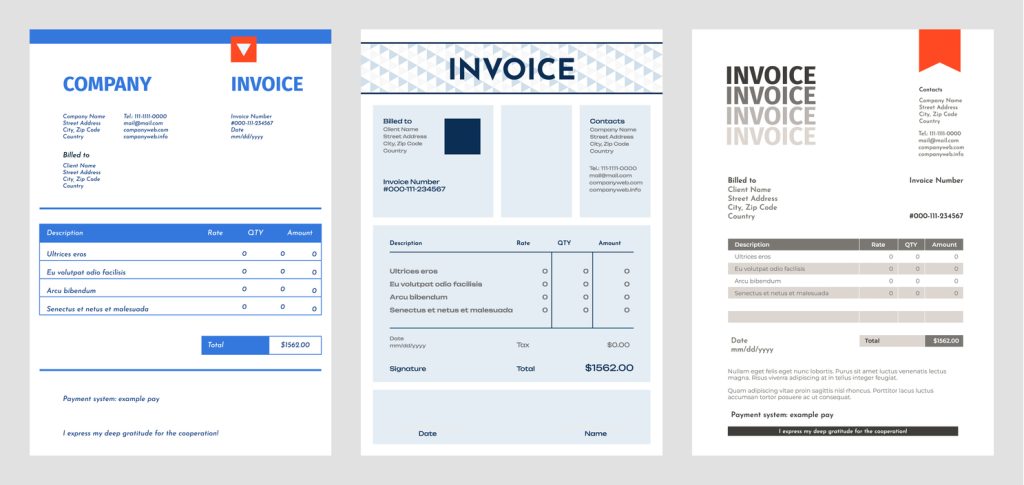

- Paystubs with inconsistent text alignment and varied typefaces that seem to have been falsified.

Similarly, technology is essential for preventing scams. For example, the pay stub generator created by ThePayStubs.com facilitates the automation of the earning, deduction, and work duration tracking processes. When these specially designed solutions are implemented, the likelihood of making inadvertent errors or being dishonest is much reduced.

It is also obvious that verification techniques are required. For instance, employment contracts, timesheets, tax returns, and even bank deposit records might be used to confirm an employee's compensation. Additionally, to reduce the possibility of employing someone with a fabricated paystub, new candidates are typically asked to provide some sort of documentation attesting to their employment history.

Legal Steps in Prosecuting Fraudulent Pay Stub Cases

When schemes involving the use of fictitious pay stubs are discovered, the most typical response is to start the criminal prosecution. Typically, there are many steps in the prosecution process:

- Reporting the Fraud: The fake pay stubs need to be reported to the appropriate authorities. This usually entails calling or visiting state labour departments as well as federal agencies like the Department of Labor. Additionally, banks may notify law enforcement about payment slip fraud.

- Gathering Evidence: It is quite difficult to find evidence to support a guilty conviction. In this instance, forensic detail is crucial. As a result, the employer ought to be able to account for all payroll documentation, including both original and altered pay slip copies. Additionally, revenue documents, employment contracts, and corporate records may support the argument.

- Legal Proceedings: One may be subject to both criminal and civil responsibility for pay stub fraud, just like for any other twisted turn in a particular system. For example, the prosecution for forgery and issuing false documents, peddling fraud, or promoting pyramid schemes or similar vices are only a few examples of cases that may be investigated in this way. In contrast to most other circumstances, the purpose of civil lawsuits, in this case, is not only to stop the fraud; rather, they are to compensate for the "costs" suffered as a result of the fraud, whereby mostly corporations and financial institutions seek to get damages.

The seriousness of the issue is somewhat explained by a few case studies of court cases using fictitious paystubs. In certain cases, it was noted that workers who falsified their paychecks to obtain credit were not simply fired; instead, they were prosecuted for crimes and given jail time and monetary fines.

Prevention Strategies for Businesses

A well-thought-out defense approach may not be enough to combat illegal pay stub practices and other types of deceit. Employers must implement strict policies and procedures that will drastically reduce the likelihood of these vices. Among the crucial actions are the following:

- Automating Payroll Systems: Every employee will receive accurate and proper paystubs if they choose trustworthy payroll services. The likelihood that an error will ever be purposeful or even unintentional is decreased by automation.

- Employee Education: Employers must periodically provide training on regulatory matters about payroll record manipulation. Additionally, this can deter the staff members from taking any needless actions.

- Audits and Reviews: It is good to undertake frequent payroll audits as a control measure. Issues like tax issues, inconsistencies between payment records and hours worked, etc., should be the focus of these checks.

Conclusion

One of the main goals of the majority of businesses and institutions, whether they are financial or not, is to identify and stop pay stub fraud. Excellent detection systems, vigilant monitoring, and excellent payroll administration assist the majority of businesses in avoiding any financial or legal exposure, even though such fraudulent behavior poses serious legal and financial risks. In addition to being genuine and accurate, these fraud protection tools are also helpful in making sure that pay stubs are appropriately formatted and devoid of false information for both the company and the employee.