Is Life Insurance Worth It? A Smart Financial Move or an Unnecessary Expense?

As of 2024, about half of Americans had life insurance. When you think of life insurance, your first thought might be about providing financial security for your loved ones after your death. However, some policies can also serve as a financial asset that you can access during your lifetime—similar to an IRA or mutual fund.

These policies build cash value over time, allowing you to withdraw or borrow against them. If structured correctly, they can even offer tax advantages.

But is life insurance really worth the cost? Let’s break it down.

Choosing the Right Life Insurance Policy

Not all life insurance policies offer the same benefits. If you're looking for a policy that can also serve as an asset, focus on cash value policies.

🔹 Term Life Insurance:

- More affordable.

- Provides coverage for a set number of years.

- No cash value or investment benefits.

🔹 Permanent Life Insurance (includes Whole Life & Universal Life):

- Lifetime coverage (as long as premiums are paid).

- Builds cash value that can be accessed.

- More expensive than term life insurance.

Types of Permanent Life Insurance That Can Serve as Assets

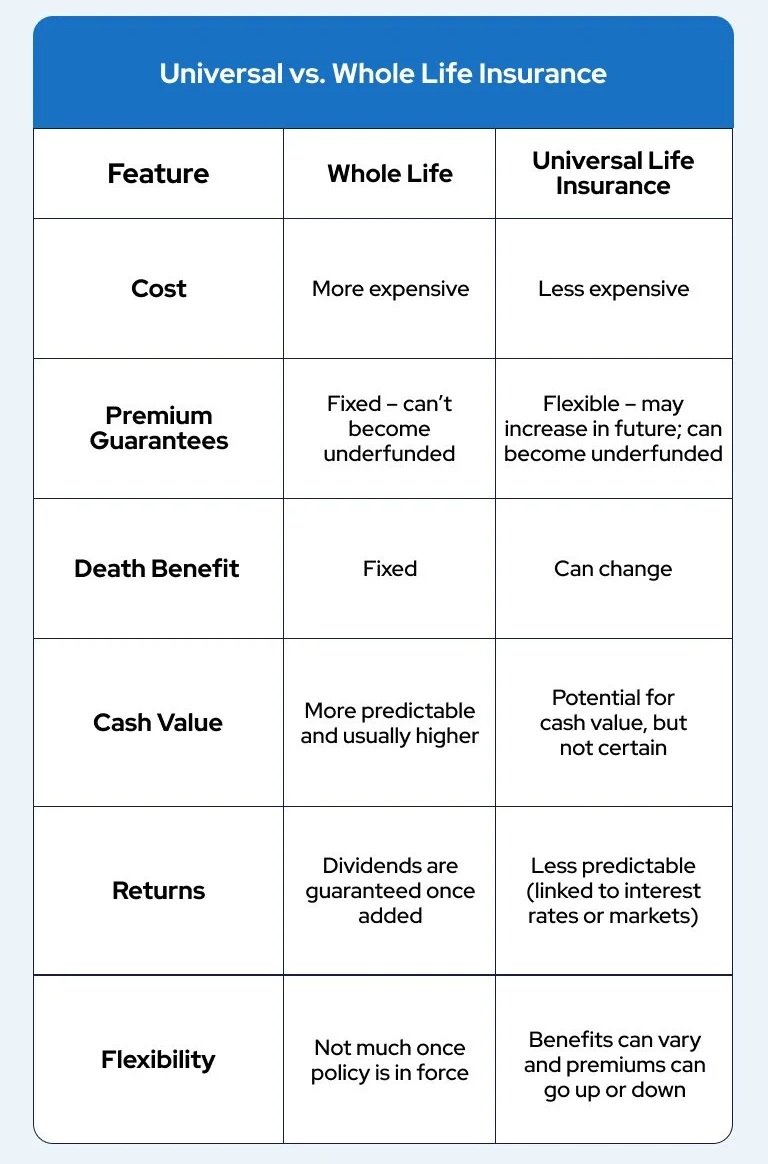

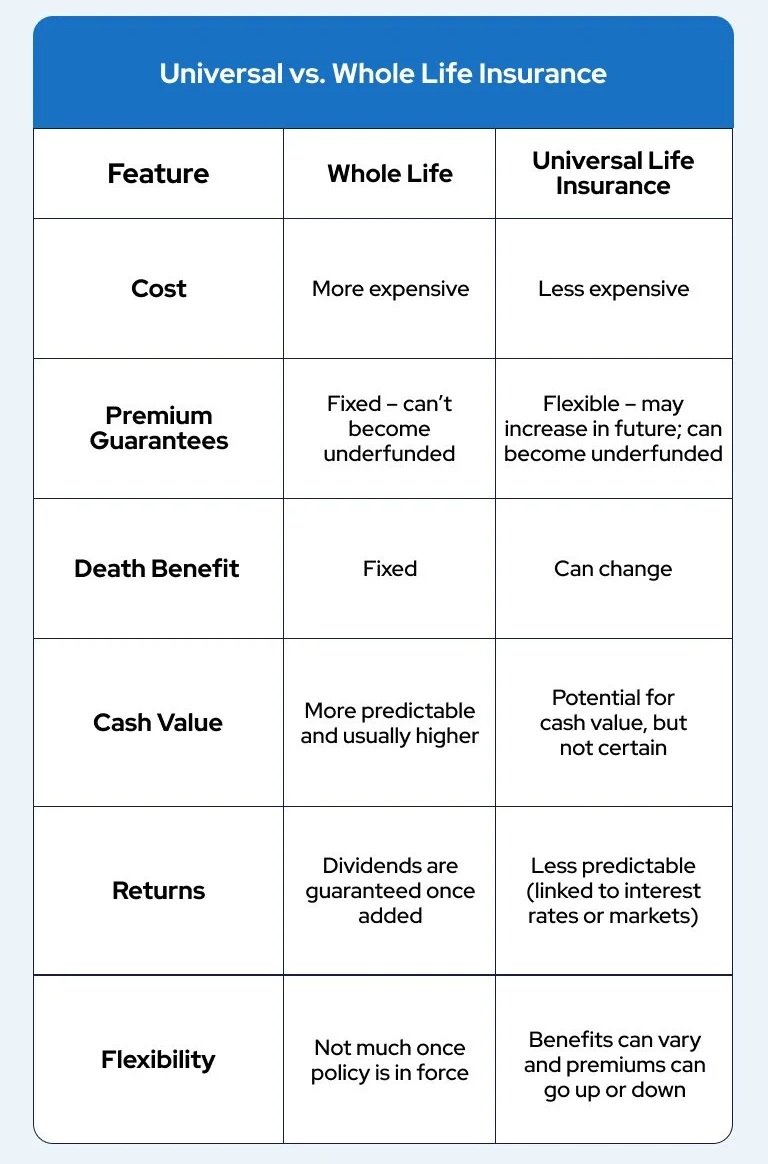

1. Whole Life Insurance

This is the most common permanent life insurance policy. Whole life insurance is the most common type of permanent life insurance and includes both a death benefit and a cash value component. It offers:

✔️ Guaranteed cash value accumulation at a fixed rate.

✔️ Premiums that remain the same for life.

✔️ A built-in savings component that grows over time.

⚠️ Key Tip: Always read the fine print to understand the guaranteed rate of return on your policy.

2. Universal Life Insurance

Similar to whole life, Universal life insurance offers more flexibility than whole life but comes with additional risks.:

✔️ Adjustable premiums (can change over time).

✔️ Interest-based cash growth (but no guarantees).

✔️ Option to invest in mutual funds with Variable Universal Life Insurance.

⚠️ What to Watch For: Since there are no guarantees on your rate of return, this type of policy carries more risk.

How to Use Life Insurance as an Asset

Permanent life insurance policies allow you to access your money in several ways:

1. Borrow Against Your Policy

You can take out a loan using your policy’s cash value.

- No approval process needed.

- Interest rates vary by insurer.

- Important: If the loan isn’t repaid, it will reduce your beneficiaries' payout.

2. Use It as Collateral for a Loan

Some lenders accept life insurance as collateral, making it easier to qualify for financing.

- Could secure better loan terms.

- If you pass away before repaying, the balance will be deducted from the payout.

3. Withdraw Funds

You can make a direct withdrawal instead of taking a loan.

- Tax-free if you withdraw only what you've paid in premiums.

- Taxable if withdrawing from investment gains.

- Reduces the total amount your beneficiaries receive.

4. Access “Accelerated” Benefits

Some policies offer early payouts in cases of severe illness (e.g., cancer, heart attack).

- You can withdraw 25%–100% of your policy’s value.

- Helps cover medical expenses.

5. Surrender the Policy (Cash Out)

Canceling your policy lets you receive its cash value—minus fees.

- Can be an option if you no longer need coverage.

- May result in high surrender charges, like early withdrawals from retirement accounts.

Is Life Insurance Worth It? When Should You Get Coverage?

Life Insurance is Worth It If:

✅ Your death would create a financial burden for others.

✅ You need to cover burial expenses (funerals can be costly).

✅ You want to replace lost income for dependents.

✅ You have outstanding debts that could pass to a spouse or co-signer.

✅ You rely on someone else’s income and want coverage on their life.

Life Insurance May Not Be Worth It If:

❌ No one depends on you financially.

❌ Premiums don’t fit within your long-term budget.

❌ Your main goal is wealth-building (there are better investment options).

Pros & Cons of Life Insurance

✔️ Pros:

- Provides a tax-free lump sum for beneficiaries.

- Can be used as a direct inheritance (bypasses probate).

- Some policies offer cash value for borrowing or withdrawals.

❌ Cons:

- Expensive compared to other investment options.

- Can be canceled if payments lapse.

- Potentially costly if the payout is less than the total premiums paid.

Final Verdict: Is Life Insurance Worth the Cost?

Life insurance can be a smart investment—but only if it fits your financial needs.

🔹 If you have dependents, debts, or financial obligations, life insurance is a valuable safety net.

🔹 If your goal is building wealth, other financial tools (like IRAs or 401(k)s) may be a better choice.

The Bottom Line: The younger and healthier you are, the cheaper your coverage. Locking in a policy early can help you secure lower rates and greater financial security for your loved ones.