81-Year-Old Veteran Billed $19K After Florida Rehab Stay He Was Told Medicare Would Cover.

SUN CITY CENTER, Fla. — An 81-year-old Army veteran was left shocked and frustrated after receiving a $19,000 bill for a rehabilitation stay he was told would be covered by Medicare. Roger Brown, a disabled veteran, had knee surgery and was admitted to rehab, only to discover months later that Medicare wouldn’t cover his stay, leaving him to face an unexpected and overwhelming bill.

Roger Brown’s Frustrating Experience

Roger Brown, who served in the Army, underwent knee replacement surgery in February 2024. After experiencing difficulty recovering at home, his wife, who is not a nurse, had trouble assisting him. Brown was then admitted to St. Joseph’s Hospital South in Riverview for additional care. However, he was informed by a nurse that a coding error had occurred, which would require him to stay an additional two days for Medicare coverage to kick in.

After this extended stay, Brown was transferred to Palm Garden in Sun City Center for rehabilitation. While his rehab was covered, he was later informed that his stay was not.

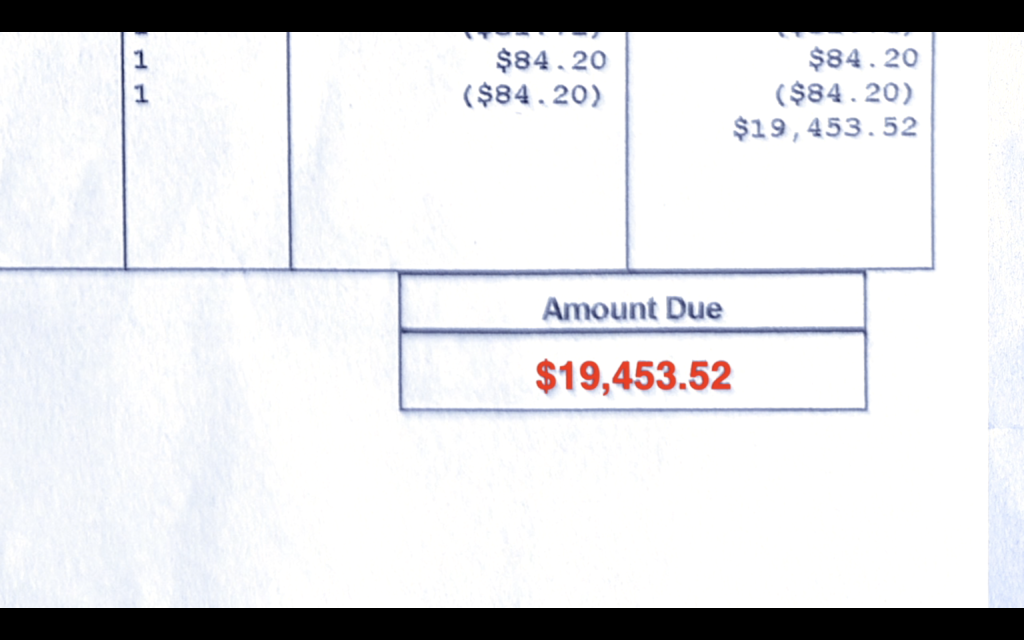

Nearly eight months later, Brown received a letter from Palm Garden stating that he owed $19,453.52 for the rehabilitation stay.

“I got a bill, which I showed you, for $19,453.52,” Brown told I-Team Reporter Kylie McGivern. “I didn't know what to do! My heart just stopped.”

After undergoing a knee replacement, a veteran entered rehab in Sun City Center, only to leave with a bill exceeding $19,000.

Confusion and Denial of Coverage

Initially, Brown was unaware that his Medicare coverage had been denied. He never received an official notification or explanation, only the large bill months later. After receiving the overdue payment notice, Brown took the letter to Palm Garden, where he was informed that the issue was due to a coding error at the hospital. Unfortunately, Palm Garden was unable to get the hospital to adjust the dates, leaving Brown stuck with the hefty bill.

Brown said the staff at Palm Garden told him that Medicare would not cover the charges and that the hospital refused to cooperate with the insurance adjustments.

“They tried working with the hospital to move dates to take care of this, and they will not work. So you got two parties trying to work, and none of them want to work together,” Brown said. “And I'm left out on an island, owing $19,000.”

Taking Action and Seeking Help

Refusing to simply pay the bill, Brown turned to his doctor for guidance. “He says, ‘Roger, don't pay ‘em a dime,’” Brown recalled. This advice led Brown to contact the Medicare Fraud Hotline for assistance.

“They said this is very important that we take this up the ladder,” Brown said.

The hotline, managed by the Office of Inspector General for the U.S. Department of Health and Human Services, is designed to handle complaints related to Medicare fraud and abuse. Dan Hoy, the director of hotline operations, expressed the importance of reporting issues like Brown's.

The Medicare Fraud Hotline: What You Need to Know

The Medicare Fraud Hotline receives around 140,000 contacts a year and is essential for investigating fraudulent claims and errors in the Medicare system.

Hoy emphasized the importance of reporting these issues, stating, “I find it extremely rewarding taking care of Medicare beneficiaries… they deserve quality healthcare, and they deserve not to be taken advantage of.”

Brown's case, along with thousands of others, shows how crucial it is for people to speak up when they encounter issues with their Medicare coverage. The hotline has led to over 2,200 investigations and the recovery of nearly $500 million over the past five years.

A Happy Ending: Brown’s Charges Dropped

After Brown’s persistence and the I-Team's involvement, Medicare reviewed the case. Finally, Brown received a letter stating he was not liable for the charges, and his balance was reduced to $0.

“You are not liable for these charges,” the letter stated, which Brown read aloud. “Your new balance is a charge of $0.”

Brown was thrilled with the outcome. “I was elated! It’s amazing,” he said. “Just a little bit of what your fine station has done, you know, to do this is just unbelievable. What a relief!”

How to Fight Back Against Medical Billing Errors

Brown’s story is an example of how persistence and using the right resources can lead to a positive outcome. If you find yourself facing a similar situation with Medicare or another insurance provider, here are the steps you can take:

- Review Your Bills Carefully: Ensure there are no errors in coding or dates.

- Contact Your Doctor or Facility: Ask for assistance in addressing billing issues or errors.

- Report Issues to the Medicare Fraud Hotline: If you believe there has been a mistake, reach out to the hotline to escalate the issue.

- Stay Persistent: Follow up regularly to ensure your case is being handled appropriately.

Conclusion

Roger Brown’s fight against the $19,000 bill is a reminder that when it comes to Medicare or healthcare billing issues, it’s important to stay proactive and seek help when needed. The resolution of his case underscores the importance of speaking up and using the proper channels to fight back against unjust charges.

If you find yourself in a similar situation, remember, don’t pay a dime until you’ve explored all your options and fought for your rights.